In the world of financial transactions, especially for Micro, Small, and Medium Enterprises (MSMEs), the assessment of creditworthiness is a critical factor that can make or break opportunities for growth and success. Ensuring that the right amount of credit is extended to these enterprises is a complex puzzle with a simple solution – Business Information Reports (BIRs).

MSMEs in India face challenges in accessing credit due to various factors, such as limited access to affordable formal credit, lack of financial records and credit histories, and traditional lending methods that rely on collateral and creditworthiness assessments.

Decoding the Nexus: Business Information Reports and Credit Evaluation

Business information reports are comprehensive documents that encapsulate a business's financial and operational history. These reports are the custodians of invaluable data, serving as a repository for information about a company's creditworthiness and financial health.

A typical BIR includes an array of critical details such as credit scores, payment history, financial data, public records, and more. Essentially, it's a condensed biography of a business, documenting its financial journey, complete with achievements, stumbles, and milestones.

The Purpose of Business Information Report in MSME Credit Assessment

Risk Assessment:

Business Information Reports provide a wealth of data that helps lenders assess the credit risk associated with an MSME. By examining financial statements, credit history, and public records, lenders can make rational decisions about whether to extend credit to the business.

Establishing Credit Limit:

Lenders can determine the credit terms and limits for MSMEs based on the data in BIR. This is essential for risk management and ensuring the business can meet its financial obligations. Lenders can also customize terms based on the specific risk profile of the MSME, taking into account its industry, financial performance, and credit history.

On-going Monitoring and Review:

Credit evaluations need to be continuously monitored because they are dynamic. Business Information Reports are an invaluable tool for monitoring an MSME's credit history and financial standing on a regular basis. This information enables lenders to modify credit terms as necessary.

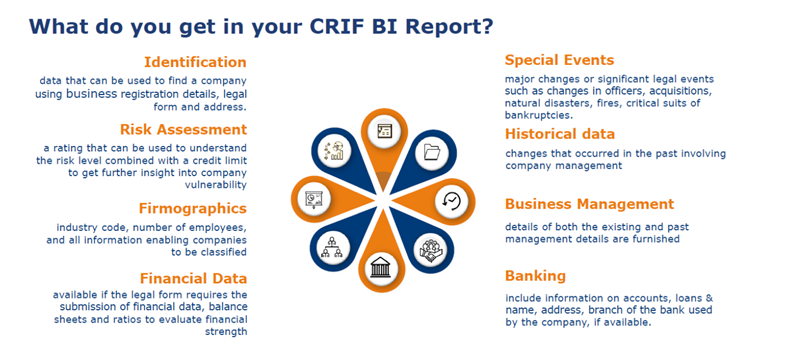

What do you get in a Business Information Report?

A Business Information Report aims to provide 360-degree information access regarding an entity or a business. This includes financial information and credit repayment history, such report also provides a risk evaluation matrix for the entities and key observations emerging out of financial information and trends.

The CRIF Advantage

From assessing a company's payment behavior to evaluating its credit risk profile, CRIF Business Information Reports serve as a strategic asset in mitigating uncertainties and fostering secure business relationships. Connect with us to delve deeper into the transformative capabilities of the CRIF Business Information Report and elevate your risk management and decision-making processes.