Credit scores have been a reliable risk marker for assessing credit risk and continue to play a crucial role in lending decisions. However, the advent of artificial intelligence (AI) has opened up new possibilities, enhancing traditional methods and bringing a fresh perspective to credit risk evaluation.

Leveraging traditional credit scoring models, lenders have established reliable methods for assessing borrower creditworthiness. However, these models may not fully account for individuals with limited credit history or atypical financial situations and financial behaviours. To address this, advancements in Artificial Intelligence (AI) are revolutionizing the process of credit risk evaluation. Integration of AI models with established practices, lenders can gain a more nuanced and comprehensive understanding of an applicant's creditworthiness.

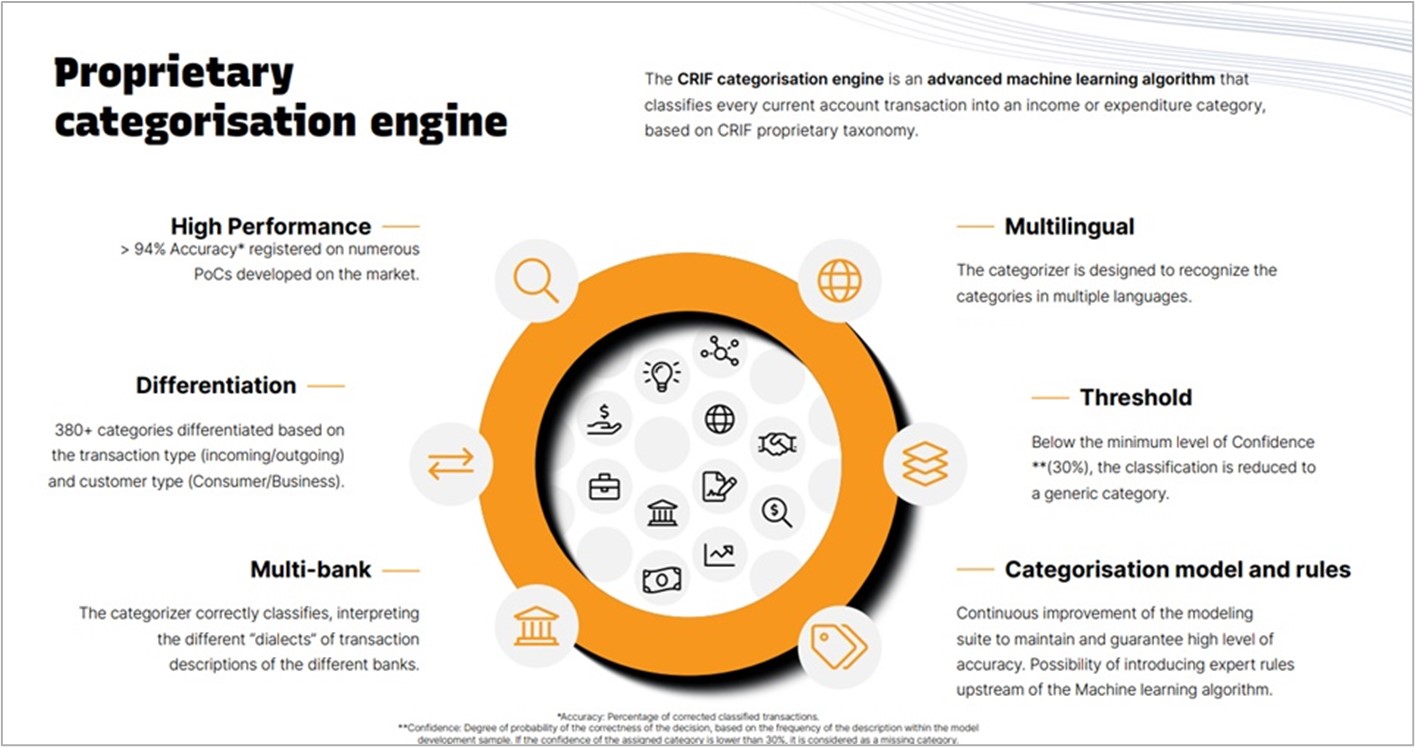

At the forefront of this technological revolution is CRIF's AI-powered Bank Statement Analytics and suite of KPI, driven by the innovative hybrid transaction Categorization Engine. Our solutions transform how lenders evaluate credit risk, offering unparalleled insights and actionable borrower level KPIs in assessing an applicant's financial health.

Our categorization engine harnesses the power of AI and machine learning technologies to analyse and interpret an applicant's bank statements. Every transaction narration in an applicant's bank statements is dissected and accurately categorized into distinct categories such as income, expenses, loans, investments, and more. This granular level of analysis provides lenders with a comprehensive understanding of an applicant's income sources, spending patterns, financial commitments, and overall cash flow management including cash flow forecasting – insights that were previously difficult to obtain through manual processes. Additionally, our solution also picks up tags embedded in the transaction narration such as method of payment, date time stamping, merchant tagging etc to sharpen the categorisation.

Imagine this: a customer makes a payment marked simply as "STORE 123." Our solution, using its sophisticated algorithms, can decipher whether it was a grocery purchase, a clothing store visit, or an entertainment expense, payment method, date time trend of such payments etc. This categorization unlocks a treasure trove of information about customer spending habits and preferences.

Our Solution “CRIF Catch”: AI-powered Insights for Smarter Lending

Catch goes beyond simple categorization. It empowers businesses with:

- Intelligent Categorization Engine: Leveraging the power of machine learning, this engine automates transaction classification with exceptional accuracy. It meticulously identifies income sources, recurring expenses, and spending patterns.

- Enhance Underwriting Efficiency: Streamline the underwriting process by automating the analysis of bank statements, reducing manual efforts, and minimizing human errors.

- Granular Financial Insights: Sophisticated AI algorithms meticulously dissect cash flow trends, income stability, and debt-to-income ratios. This provides lenders with a more comprehensive and data-driven assessment of a borrower's financial health, empowering them to make informed risk-based decisions.

- Proactive Fraud Detection: Anomalies and potentially fraudulent patterns are flagged, allowing lenders to proactively identify and mitigate risk, safeguarding the integrity of their lending portfolio.

- Enhanced Customer Experience: By leveraging advanced analytics, lenders can offer tailored products and services that better align with an applicant's financial profile, leading to improved customer satisfaction and loyalty.

Beyond the One-Size-Fits-All Approach

Predefined Categories: Catch comes with 300+ subcategories. It includes a two-tiered categorisation taxonomy/ontology. Macro- categories encompass the broader transactional context (e.g., Shopping). Micro-categories delve deeper, specifying the precise transactional subject (e.g., Shopping - Clothing).

CRIF's AI-powered Bank Statement Analytics and Suite of KPIs represents a significant leap forward in credit risk assessment. By harnessing the power of artificial intelligence, this innovative solution empowers financial institutions to make faster, more informed lending decisions with greater confidence.

Unlocking the Power of Customer Data

CRIF Catch is a valuable tool for businesses seeking to unlock the power of customer data. By transforming unstructured transaction data into actionable insights, Catch empowers businesses to make data-driven decisions, improve customer relationships.