Wilfred Sigler

Managing Director, VAS- India & South Asia Markets, CRIF Solutions

The debt collection landscape in India is complex, influenced by a myriad of factors, including economic conditions, borrower behaviour and regulatory frameworks.

The Reserve Bank of India (RBI) plays a pivotal role in shaping this landscape through its policies and guidelines, aiming to protect borrowers while ensuring the smooth functioning of the credit ecosystem. However, financial institutions often face challenges in navigating these regulations while effectively recovering dues.

Key Challenges in Debt Collection Process for Financial Institutions

Financial institutions are grappling with rising default rates, regulatory pressures, and the need to manage extensive portfolios of collection management, including non-performing assets.

Key issues such as:

- Identifying high-risk accounts and predicting potential payment behaviour

- Developing targeted data-driven collection strategies to increase the efficacy of the collection effort

- Automation of strategic action to be executed at a customer level

- Managing multiple communication channels and outreach efforts

- Ensuring compliance with regulatory requirements and industry standards

- Analysing and optimising collections performance in real-time

- Fragmented data across various systems, hindering effective debtor profiling and risk assessment.

- Heavy reliance on manual processes leading to delays, errors, and increased operational costs

Collection Process Optimization for Enhanced Efficiency

Industry needs:

- Use of analytics to increase collection efficiency: A pre-delinquency model, coupled with early, late, and collection/recovery scorecards, forms a comprehensive framework for effective debt management. By leveraging advanced analytics, organizations can significantly enhance collection efficiency. Predictive modelling enables granular debtor segmentation, optimizing resource allocation and recovery strategies.

- Automation of debt collection strategies at the customer level leads to faster, more efficient, and effective recoveries. By leveraging AI and machine learning our solution streamline processes, reduce manual intervention, and provide real-time insights, enabling you to focus on high-value recoveries while ensuring compliance and improving customer satisfaction.

CRIF StrategyOne: Advanced AI-Powered Debt Collection Solutions

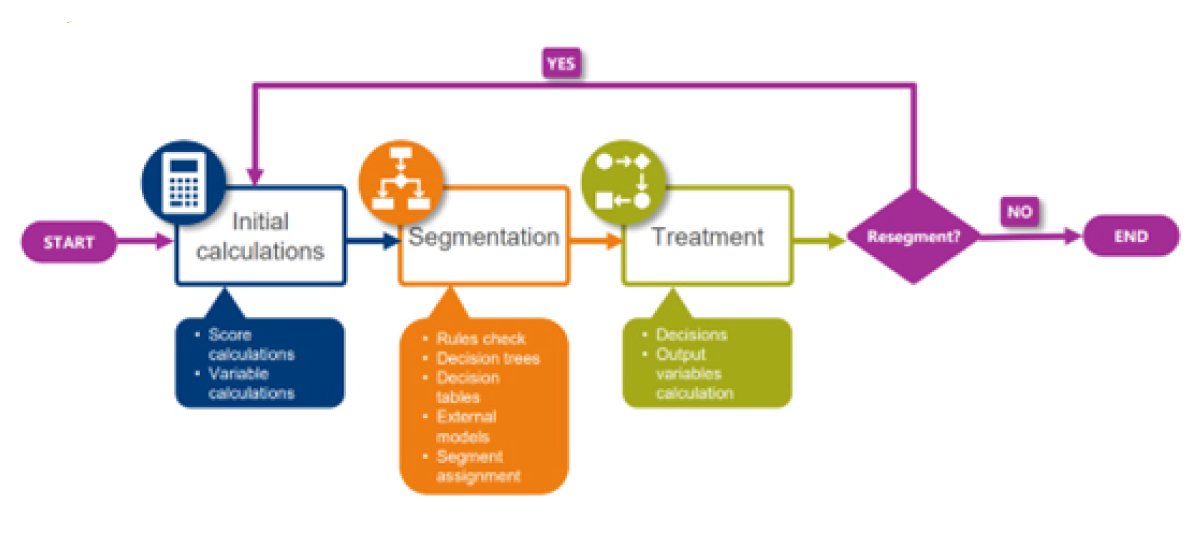

CRIF StrategyOne, a Forrester-rated AI-powered business rule decision engine, efficiently automates the execution of collections policies, scorecards, segmentations, and collection management strategies, as well as the assignment of channels and partners—all without requiring any coding. Business users can easily manage and modify these elements with just a few clicks without needing specialised IT support.

Key features of StrategyOne include:

- Data Ingestion: Gather and enhance data from various systems to create a comprehensive debtor profile

- Advanced Segmentation and Scoring: CRIF StrategyOne runs precise segmentation of debt portfolios by applying sophisticated algorithms and external models, such as Python and PMML. This allows institutions to categorise debts based on various criteria, including the type of creditor, type of debtor, etc. By accurately segmenting debts, financial institutions can tailor their collection management strategies to specific segments, improving recovery rates and reducing risks.

- Automation and Operational Efficiency: The platform automates the entire debt collection process, from pre-collection activities to execution. It integrates with the existing collection engine to streamline operations, reduce manual interventions, and ensure that the right actions are taken at the right time. The decision engine templatizes various actions, such as sending SMS, emails, or letters, ensuring that each step of the process is executed efficiently and in compliance with business rules.

- Technology-Enabled Collections: Leveraging advanced technologies such as AI, machine learning, and automation to enhance collection effectiveness.

CRIF StrategyOne delivers customisable solutions for financial institutions and offers comprehensive Collections as a Service (CaaS) solution, available in both Batch Mode and Real-Time.

Boost Your Collections with AI-Powered Efficiency – Contact Us Today to Implement CRIF StrategyOne's AI-Powered Debt Collection Solutions and know how it can help you achieve optimal results with a customer-centric approach.