Wilfred Sigler

Managing Director, VAS- India & South Asia Markets, CRIF Solutions

In today's digital age, consumer behavior is characterised by an insatiable appetite for instant gratification. From seamless UPI payments to the convenience of e-commerce and on-demand entertainment, consumers expect a frictionless experience across every touchpoint. This digital revolution has fundamentally reshaped how we interact with the world, and the financial services industry is no exception.

Gone are the days of lengthy loan application processes and agonizing wait for approvals. Today's loan seekers crave instant decisions. This is where CRIF Customer Journey as a Service (CJaaS) steps in, offering a powerful solution for lenders to streamline loan origination and cater to the evolving needs of their customers.

CRIF CJaaS: Orchestrating a Seamless Customer Journey

CRIF CJaaS goes beyond traditional loan origination systems by providing a comprehensive suite of tools and services that empower lenders to orchestrate a frictionless customer journey. Imagine a borrower applying for a loan – a few clicks on their smartphone, and within seconds, they receive a decision.

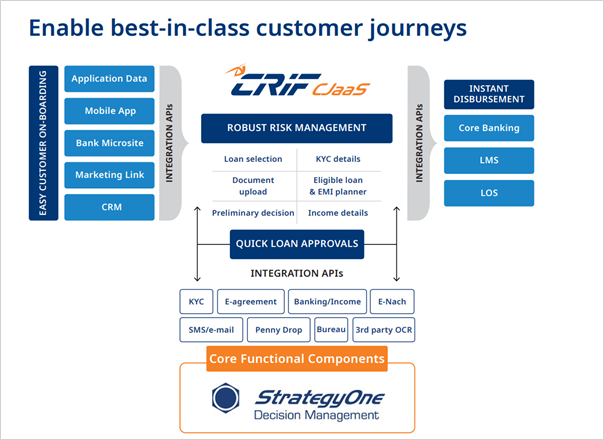

CRIF’s Customer Journey as a Service (CJaaS) is a fully integrated digital onboarding platform for personal loans, unsecured business loans, and vehicle loans for Two Wheelers or Cars. Here, solutions for customer onboarding, risk assessment, account aggregation, KYC, and credit underwriting are pre-configured to enable real-time decisions.

Here's a glimpse into how CRIF CJaaS streamlines the loan origination process:

- Digital Onboarding: CRIF CJaaS facilitates a completely digital onboarding experience, eliminating the need for physical paperwork. Borrowers can submit applications and supporting documents electronically, ensuring a faster and more convenient experience.

- Real-time Decisioning: CRIF CJaaS leverages AI and machine learning to assess loan applications in real-time. This eliminates lengthy wait times and provides borrowers with an instant decision on their loan eligibility.

- Enhanced Risk Management: CRIF CJaaS integrates seamlessly with credit bureaus and other data sources to provide lenders with a holistic view of the borrower's financial health. This enables lenders to make informed decisions while mitigating risk.

Benefits Beyond Efficiency

The digital customer Journey within CJaaS works seamlessly:

Unified and Highly Flexible

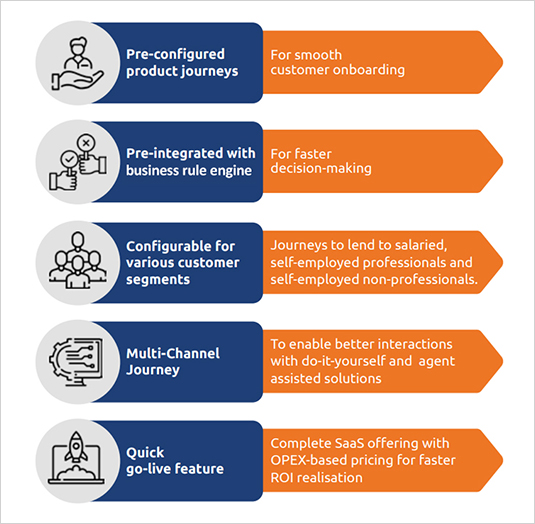

CRIF CJaaS can be easily customized to fit different loan types. It is designed on a flexible, configurable, and rule-based workflow engine, enabling the core Loan Origination System (LOS) to be seamlessly extended to various secured and unsecured loans.

Building Smart Digital Journeys

- Reduce TAT and bridge the digital gap in terms of operations and documentation.

- With CRIF's end-to-end services, create a seamless journey by consolidating digital logins, verifications, decision-making, and onboarding, onto a single screen

- Gain customer loyalty and retention with pre-approved offers.

- Go live in 60-90 days with pre-configured customer journeys

CRIF CJaaS goes beyond simply automating processes. It empowers you to design smart digital journeys that cater to your specific customer segments and risk profiles. This allows you to personalise the onboarding and loan origination experience, leading to higher conversion rates and improved customer satisfaction.