With evolving global business practices and changing customer expectations, sustainability has been at the forefront of the strategic planning of modern businesses, influencing their ESG reporting over the last decade or so. Companies must pay attention to their operations' environmental and social effects to create a sustainable competitive advantage because being profitable alone is no longer adequate.

That is why the term "ESG" began gaining traction since the early 2000s, driven by the growing recognition that environmental, social, and governance issues are interconnected and that a holistic approach is needed to evaluate a company's performance.

What is ESG & know the impact of ESG on corporate reputation?

ESG stands for environmental, social, and governance. These are knowns as the pillars in the ESG framework that represents a business’ corporate financial interests while aligning them with sustainability and ethical impacts, putting a system in place that ensures corporate accountability and manages implications in areas like carbon footprint. The goal of ESG is to measure the non-financial risks and opportunities of the companies, particularly in terms of their ESG impact.

The environmental factor considers the company's outlook toward protecting the ecosystem and natural resources (climate change, energy consumption, carbon footprint, and use of natural resources. The social factors focus on how the company treats people (employees, customers, and surrounding communities), and the governance focuses on internal policies, practices, and controls of the company (leadership and management, transparency, and industry best practices).

Why ESG is Critical for Financial Performance and Corporate Reputation

Beginning in the 1960s, the practices surrounding

ESG investing, or sustainable investing, have evolved from socially responsible investing, where investors exclude certain stocks of entire industries based on their business operations and their social or environmental impact.

Modern iinvestors are more interested in putting their money where their values are, particularly in relation to the impact of ESG on financial performance. Since 2019, modern investors have invested $140 million in companies with ESG policies.

79% of the investors in a PwC study rate ESG as an important factor influencing their investment decisions, 49% said they would consider divesting if the company does not implement ESG policies, and 75% consider short-term profitability a worthy sacrifice to address ESG issues.

So, if you are looking for funding, you have a better chance of attracting investments if you are ESG compliant. Additionally, companies that have well-performing ESG policies have demonstrated higher financial growth along with higher employee productivity, lower operational costs, lower volatility, and fewer regulatory interventions.

Addressing ESG Risks in Supply Chains to Protect Corporate Reputation

ESG risks are receiving more public attention, which has brought to light the need for businesses to carefully monitor their suppliers from an ethical and environmental standpoint to preserve their brand reputation and image.

While many investors now recognise the importance of ESG factors, there is still some scepticism about the reliability and viability of ESG data, which can affect perceptions of corporate financial performance.

From an Environmental, Social, and Governance (ESG) perspective, some of the most significant issues in the supply chain besides human rights and labour rights are:

Environmental sustainability risk :

This includes reducing the carbon footprint of supply chains, reducing waste and resource consumption, and promoting environmentally friendly practices throughout the supply chain.

Transparency risk :

Improving supply chain transparency ensures that all parties are held accountable for their actions and that ESG risks are managed effectively.

Supply chain security :

Disruptions are commonplace as businesses become increasingly interconnected. Maintaining the security and stability of the supply chain to prevent disruptions, ensure quality, and protect against fraud, counterfeits, and other forms of exploitation is essential for strong ESG performance. With the emergence of new threats like ESG compliance and cyber-attacks, as well as traditional supplier risks like bankruptcy, companies must have a robust framework for managing these risks and integrating ESG initiatives.

Mitigating ESG Risks to Enhance Long-Term Financial Success in Their Supply Chain

Addressing ESG issues in the supply chain requires a commitment from all parties involved, including suppliers, manufacturers, and consumers. To prioritise ESG considerations in their operations and purchasing decisions, companies must focus on:

Data collection :

Organisations must start collecting data on the risks involved in their supply chain. Identifying and assessing the ESG risks associated with the suppliers and the sourced products is essential for understanding the relationship between ESG and financial performance, as well as the effect of ESG on firm performance.

ESG risk assessment :

The growing complexity of supply chains and the tightening of sustainability regulations make it increasingly necessary to consider the suppliers included in a company's supply chain. ESG risk assessments help organisations understand the environmental, social, and governance risks associated with the suppliers and the impact these risks may have on the reputation and operations of the company.

A comprehensive approach to assessing growing ESG risks :

ESG risks in the supply chain is growing and need to be addressed from a holistic perspective. This includes considering the entire supply chain, from sourcing raw materials to delivering finished products, and assessing the ESG risks at each stage. Companies must identify and prioritise risks, strengthen cybersecurity defences, perform due diligence when selecting suppliers, and conduct regular reviews of existing partners for both traditional and new threats to prevent and mitigate operational risks in their supply chain.

How Synesgy Can Help You Identify ESG Risks within Your Supply Chain

Focusing on supply chain ESG can be a great starting point if you want to start developing and implementing ESG strategies and policies within your organisation, as a majority of the ESG footprint of many businesses comes from within the supply chain rather than the business operations. And, therefore, can create a more impactful result.

Looking deep into the supply chain can help you understand where the materials are coming from, what journey they take before reaching you, and how they touch the surrounding communities, ultimately affecting corporate performance. As a result, you can identify and eliminate any ESG risk factors, such as involvement of child labour, utilisation of conflict materials or negative impact on environmental and ecological sustainability. And you can not only mitigate these risks but create a positive impact for a more sustainable supply chain.

Synesgy, a global digital platform powered by CRIF, can help you assess ESG within your supply chain with sustainability assessment and rating. With Synesgy, you can collect and manage your sustainability information via ESG self-assessment while also gaining insights about evaluation, benchmarks, and guidelines for further development.

As a result, you can use the Synesgy ESG score to:

- Implement monitoring tools that promote transparency.

- Identify and map ESG risks within your supply chain.

- Actively track the ESG risks of your suppliers to streamline your ESG processes.

- Strengthen your ESG goals.

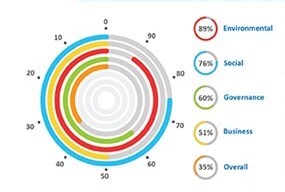

The Synesgy score facilitates easy visualisation of your ESG score across five categories - environmental, social, governance, business and overall. And with support across 60+ countries, 150+ supply chain enterprises and 500+ banking and insurance institutions – in 25+ languages – you can drive sustainability and build a long-term sustainable value proposition and sustainable advantage.

Sustainability is driving today’s market, requiring companies to revolutionise their policies and practices. Don't get left behind on the road to sustainability; get in touch with CRIF today to take an ESG self-assessment to understand your supply chain sustainability risks and improve your ESG sustainability.

Conclusion: Build Financial Strength and Reputation with ESG

Focusing on ESG factors is essential for modern businesses to thrive. By adopting robust ESG practices and leveraging tools like Synesgy, companies can protect their corporate reputation, ensure compliance, and achieve long-term financial success.