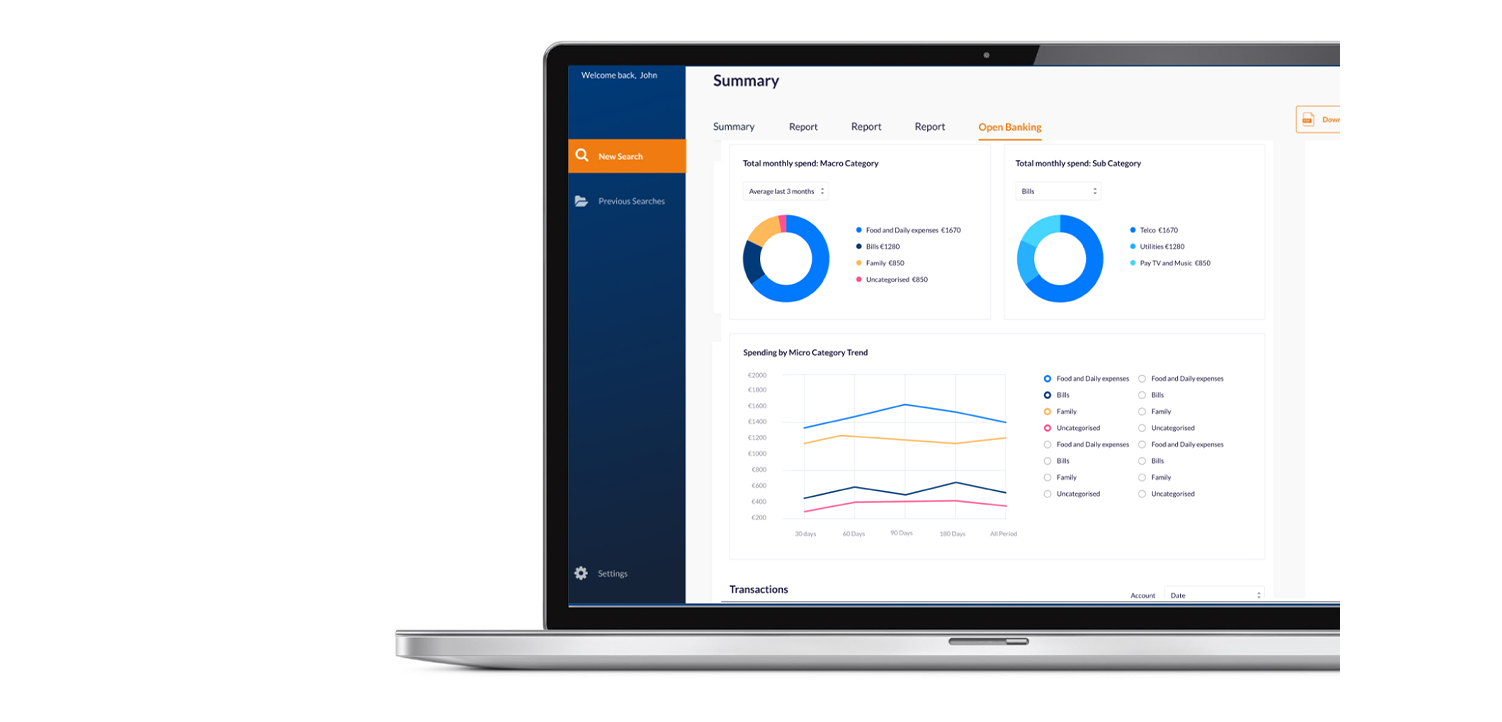

CATCH: AI-Powered Transaction Categorization Engine

Unlock Smarter Insights for Financial Decision-Making

CATCH is an AI-driven categorization engine that enables businesses to automatically categorize and analyse customer transactions with unmatched accuracy. Designed for financial institutions, NBFCs and fintech companies, CATCH transforms complex data into actionable insights that drive smarter financial decisions.