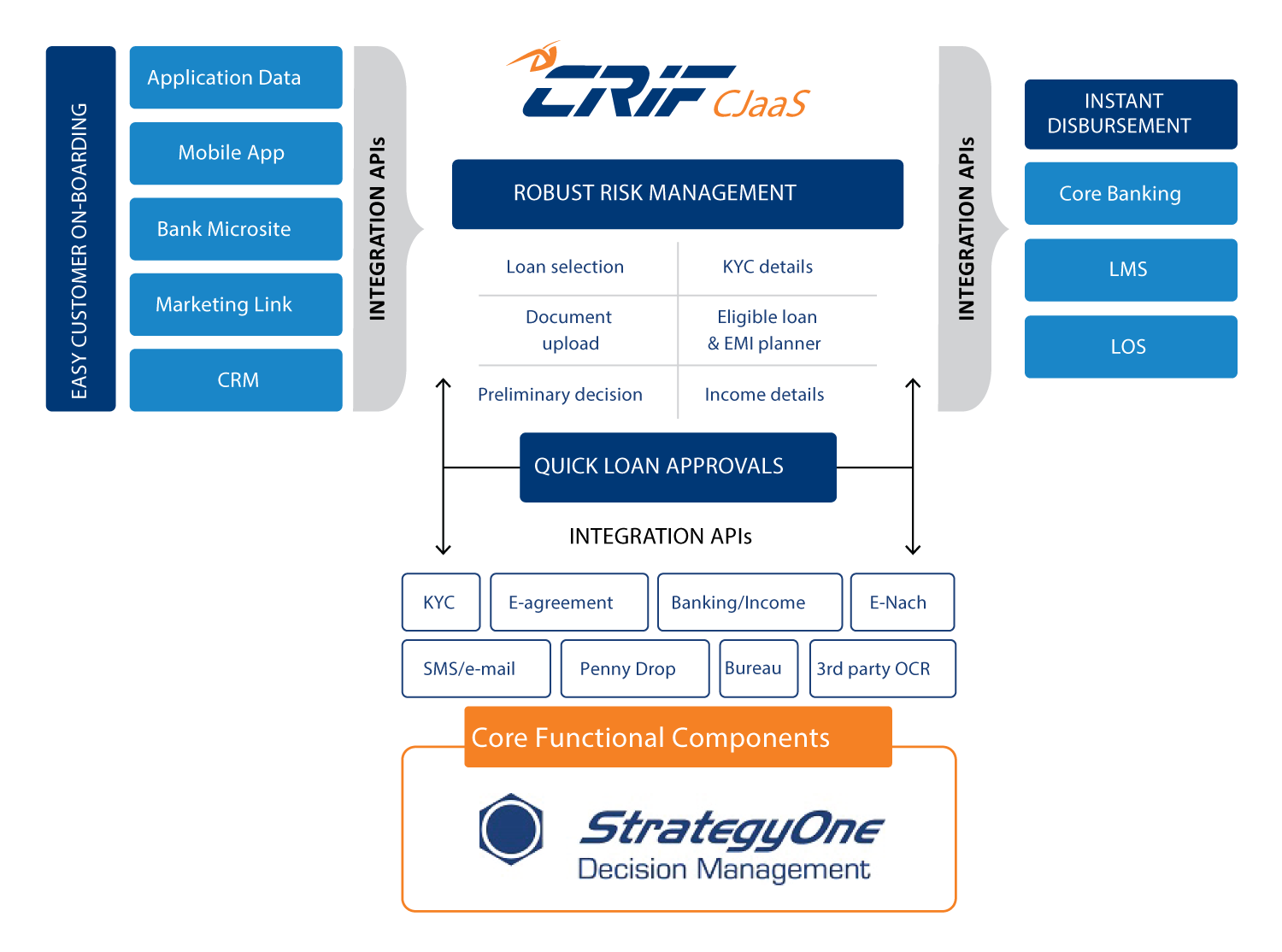

Smart Digital Journeys for Unmatched Customer Experience and Risk Management

When it comes to loan applications and disbursals, customers expect personalised choices and instant responses. CRIF’s Customer Journey as a Service (CJaaS) is a fully integrated digital onboarding platform for Personal Loans, Unsecured Business Loans and Vehicle Loans. Here, solutions for customer onboarding, risk assessment, account aggregation, KYC and credit underwriting are pre-configured to enable real-time decisions.